|

One Extra FICO Point Can Save You Thousands of Dollars

Having a good FICO score (above 740) can save you thousands of dollars in

mortgage fees.

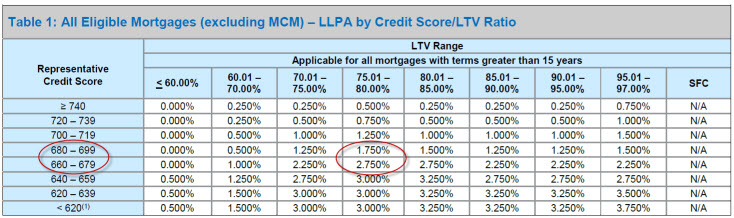

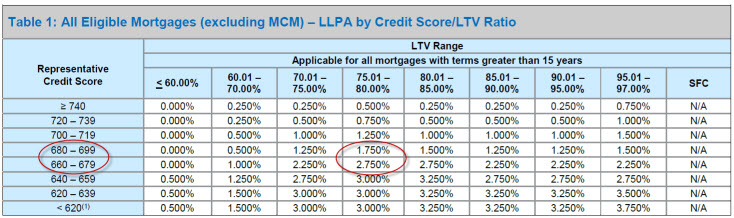

Fannie Mae has a

Loan-Level Price Adjustment (LLPA) Matrix. This chart shows you the

extra that is charged depending on your credit score and how much you put down.

For example, take a look at the figures that I circled in red. You are

charged a full extra point in fees if you have a credit score of 679

vs. 680 for a loan where you put 20% down.

On a $300,000 mortgage, that would be an additional $3000 in upfront fees that

would be required. If you didn't want to pay it upfront, you could roll it

into the interest rate which would increase

your rate by about 0.25% . Every point is equivalent to roughly a

1/4 % increase in your mortgage rate. So

in this example, a instead of a rate of 4.0%, you would get a rate of 4.25%.

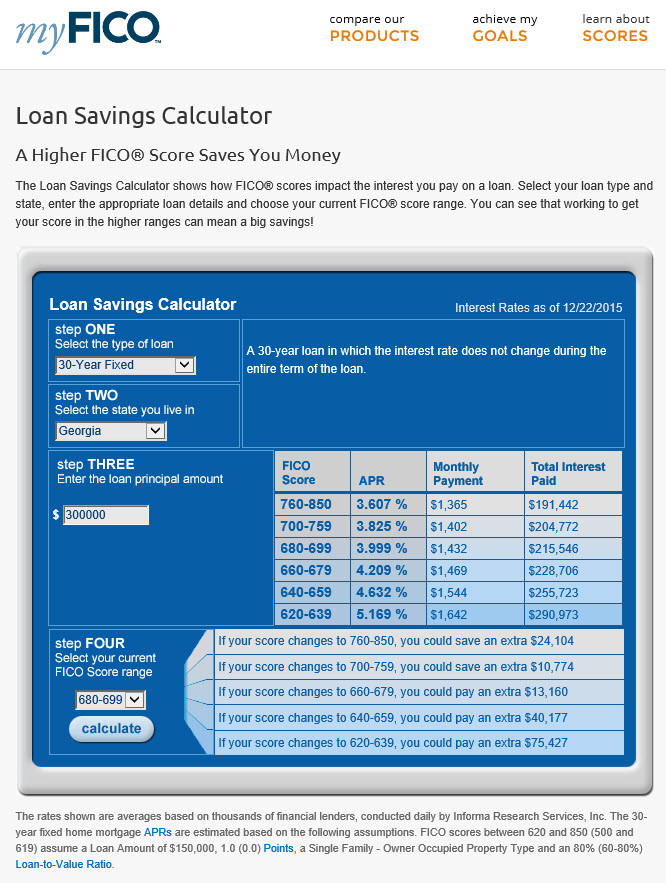

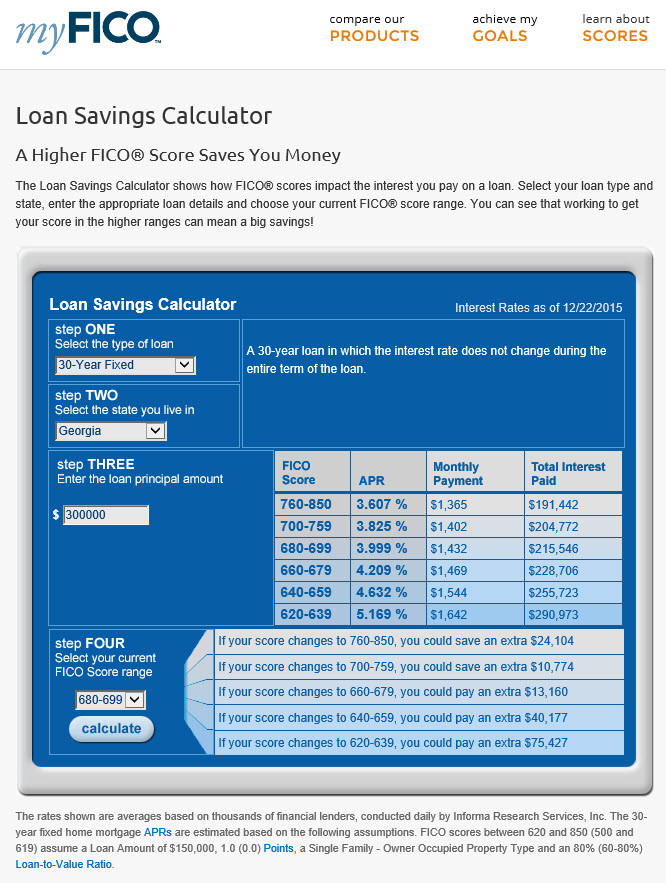

myFICO.com has a calculator that estimates the different pricing for different

credit scores.

This is why it's impossible for a lender to quote you a particular mortgage rate

without knowing your FICO score. If they do, they are just making

assumptions. If the next lender makes different assumptions you'll be

comparing apples with oranges.

You should know what your FICO score is before you

start talking with any lenders. You can have a lender pull your credit

score but every inquiry will bring your score down a bit. If the inquiry is

made by the consumer, your credit score isn't affected.

Don't waste your time with the "free" credit scores. Those use a different

scoring system. They aren't the FICO scores that most lenders use.

Also, you are entitled to your free credit report every year but that report

doesn't include your credit scores. It's just a report

with all of your credit accounts.

I wrote a separate report on what you get with the

free credit report

sites.

You can go to

www.myFICO.com . The three scores will cost you $59.85. There are

three credit bureaus and your score will probably differ on all three.

Usually a lender will use the score in the middle as the one to base your

pricing on.

Knowing exactly what your FICO scores are allows you to plan ahead. If

your score is well above 740, you are set. There's really no difference

between a 760 score and an 820 score except for bragging rights. But as

you see from the original example, a change in one FICO point can mean thousands

of dollars.

A good loan officer can usually help you get your FICO score up a few points to

the next tier of pricing. Maybe you have one credit card that is maxed out which is making

your credit utilization ratio high. Possibly by splitting the balance over

two credit cards your credit utilization ratio might be lowered which might

increase your credit score just enough to make a difference. The loan

officer can then help you with a rapid rescore to get the changes recognized by

the credit bureaus in a few days instead of waiting a month.

If you are frugal like I am, there's a way to actually get all FICO scores for free if you have

the right credit cards.

The

Discover Card gives you your FICO score from TransUnion

The

Chase Card gives you your FICO score from Experian

The Citi

Card gives you your FICO score from Equifax

If you have these cards, use them. If you're like me, you probably have

these cards and didn't realize they had this nice little benefit. But

don't get new credit cards just for this reason because new lines of credit can

ding your credit scores. Because of this, it's probably best to just spend

the $59.85 at www.myFICO.com and not take

the chance of it affecting your credit scores.

Tim Maitski

Atlanta Communities

www.HomeAtlanta.com

404-216-0472

|